Save Money! File Your Taxes Online For Free

It’s tax time again! Here’s some information on how you can file your taxes online in Canada for free, easily for individuals. Basically all you need to do is create an online account with Revenue Canada, download tax software, fill it out and submit! It’s much easier than you’d think, and best of all you can do it completely for free. Don’t go to H&R Block to do your taxes, do them online for free. See below for a list of paid and free software you can use to file. If you need more help, Revenue Canada has put together a guide on filing your taxes.

Easiest taxes to file? When you have just T4 slips

Table of Contents

- Filing Your Taxes Online Using Software

- Use Studio Tax To File Your Taxes

- What do I need to file my taxes?

Note: the information on this page is for individuals only and will be of no help for corporate taxes.

Filing Your Taxes Online Using Software

Netfile is the name of the service Revenue Canada has that allows people to file their taxes online. In order to use this you’ll need set up your account with them, and download tax filing software. Revenue Canada does not have tax filing software of their own, so you’ll need to choose from a list of approved programs to do your taxes online for free in Canada. Some programs are free, some cost money.

Free Tax Software

- AdvTax (online/mobile)

- GenuTax Standard (Windows)

- H&R Block Online Tax Software There is a free option (online/mobile)

- Simple Tax (online/mobile)

- Studio Tax (Windows/Mac)

- TurboTax Online Free (Windows)

Paid Tax Software, some with Free Offerings

- Each Tax $5.99 first return, $3.99 thereafter

- Fast and Easy Tax $10.99 or free if income under $20,000. Android/iOS apps available.

- H&R Block Online Tax Software $15.99 and up

- Tax Chopper Online $9.98 and up

- Tax Freeway $9.95 – $14.95

- TaxTron Free if $31,000 or under. $12.99 if over

- TurboTax Online Free if a ‘simple tax situation’

- UFile Online $19.95 and up

- WebTax4U Free if submitting non-employment income. $13.99 otherwise.

From all of these, I suggest you use Studio Tax. I’ve been using it for years without any issues. It’s free with no ads and is easy to use. They also have a Windows and Mac version. Although it is free, there is a maximum of 20 returns you can file. Not sure why you would need that many anyway.

Studio Tax can also connect to your Revenue Canada account and auto-fill in your slips!

Use Studio Tax To File Your Taxes

- Download Studio Tax for free. Available for Windows or Mac. They do accept donations!

Install it, run it. From here you just fill out the information it asks for and you’re golden. Read through every question carefully and answer everything. When it comes time to fill in the information from your T4 or other slips, just simply type the same numbers in the same boxes. It’ll walk you through everything right until the end, and you’ll be able to file it.

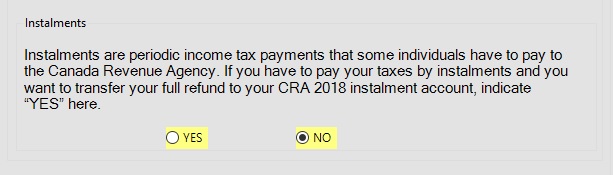

Here’s an example question:

You would want to make sure you check NO, unless you make installment payments. Super easy, so long as you’re able to read and comprehend English.

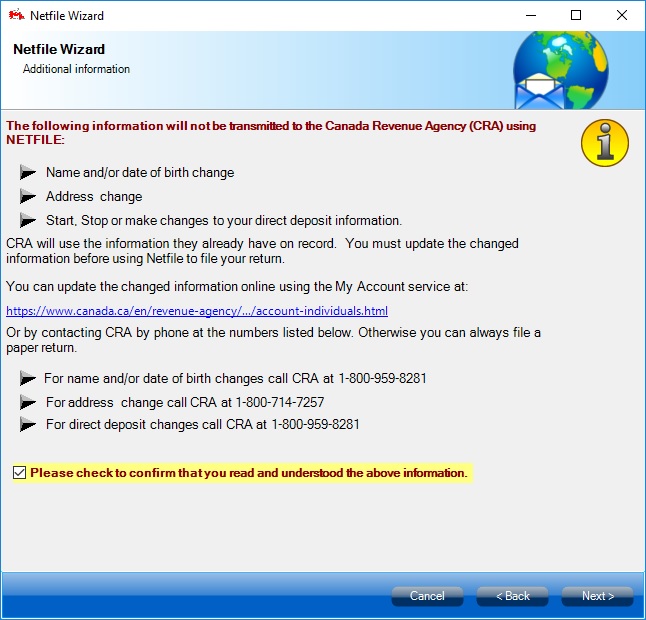

Information is presented to you clearly, and they explain everything. There’s also another reminder that your information needs to be up to date within Revenue Canada’s database. The numbers are provided if you need to call. Handy stuff.

Once your return has been sent to Revenue Canada you’ll be given a confirmation ID to show that it did in fact transmit to the Government and you’re golden.

What do I need to file my taxes?

First and foremost you need your slips (the little piece of paper your employer gives/mails to you with all the numbers in the boxes), or at least the information from them. Most people only have a T4 slip (income tax) from working their regular job and earning a single income. Only having a T4 makes filing your taxes extremely easy. Note! before you file online, make sure your information is up to date with Revenue Canada. If you attempt to file online with a different address than they have on file, it might be rejected.

You can call Revenue Canada and request that they mail you a replacement slip, and, read the values to you from the boxes so that you can file your taxes. You don’t need the physical copies anymore, just the information. Don’t hesitate to call them up.

In addition I would recommend setting up direct deposit before you file your taxes. It’ll speed up the process immensely, you’ll get your return in 8-9 days if filed online.

You can give them a call at 1-800-959-8281.

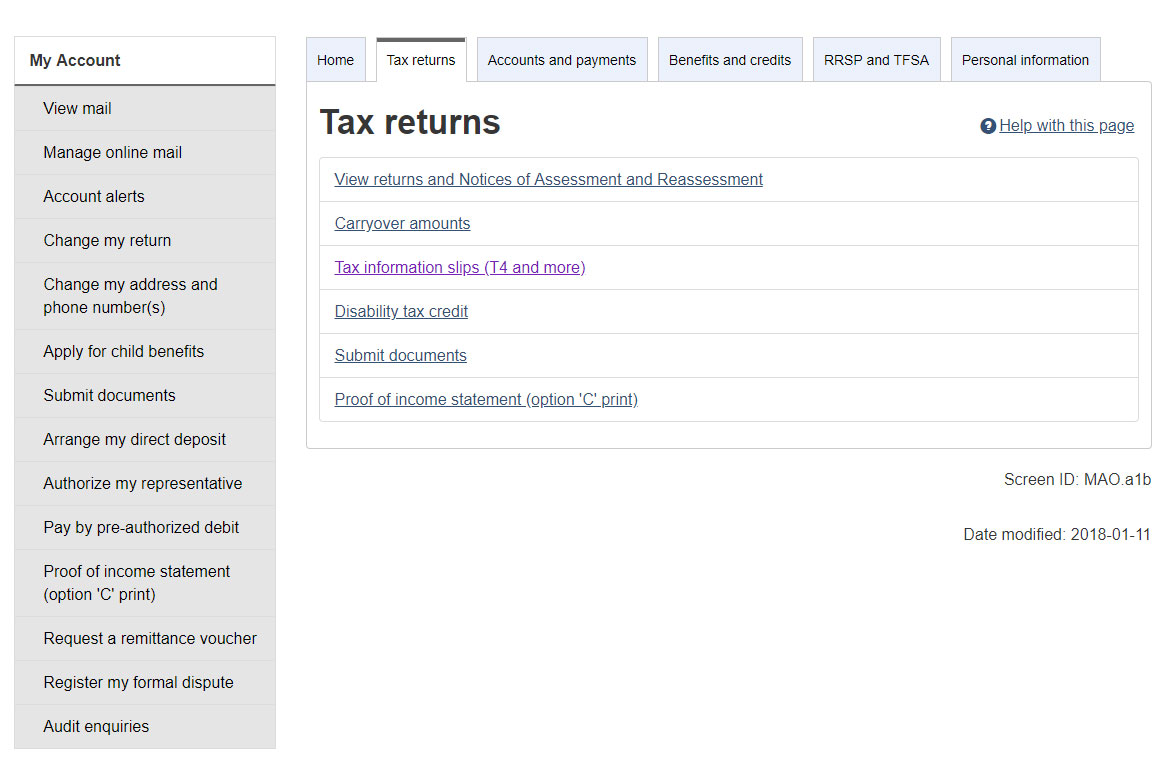

My Account for Individuals

In order to file your taxes online, you’re going to need to sign up for “My Account”. Do that here. Through this account you can monitor your returns, track things, change info etc. It’s incredibly handy to have all of this information online. When signing up, you will need a copy of your previous years taxes as they ask for specific line amounts and that question changes each time you login. So for example you can’t start registration, go find line number ‘x’, come back and login.

Bonus: your tax slip information is included here, so if you don’t have your T4 slip, your employer will have sent in their copy, so you can still get the information you need to file.

Make sure to save the login information for this, you’ll need it again in the future.

In Conclusion

There are many different options for you to file your taxes online for free! Save your money, don’t go to those mall kiosks or H&R Block. Do your taxes yourself if at all possible. Help a senior with theirs online. Do your inept friends taxes online for them.

What makes me an expert on this stuff? Hah, I am no expert but thank you for the kind words. Full disclosure: I have worked at the Canadian Revenue Agency as a taxpayer service agent, taking calls from Canadians about all sorts of tax situations. I would help them with sending out slips, providing info, that sort of thing. This was back in the late 2000’s, so I am a little out of date on certain topics, but I do have sort of a background in this. Also? Mrs Crackmacs works in a tax office.

Happy filing! Hopefully you get a nice big fat return.

Please drop any questions you may have in below and we’ll do our best to help.

Blogging in Calgary.

Follow along on Facebook, Instagram, Twitter. Join the Calgary Discord Server!

If you are looking to backdate your tax returns, Tax Warriors can help. http://www.taxwarriors.ca

You can download your information from the CRA into almost all of those tax software programs. It’s a free service from the CRA so all the tax software out there take advantage of it.

Turbo is the worst for getting you through most of your return before you realize you have to pay for “that type” of return.

The H&R Block software has a few ads but is actually free to do any type of return AND file plus has the option to download your info from CRA/RQ for free.