Ever Lose A GST Cheque?

If you’ve ever been sent a cheque by the government, you might remember how easy those things are to misplace before you get a chance to cash it. Maybe a cheque was mailed to you but at a previous address. Maybe someone stole your mail. Maybe you threw it out accidentally. No matter what happened to the original cheque, if it was never cashed, that money is still available and waiting for you! Thankfully, direct deposit exists and it’s easy to set up to prevent this from happening in the future. You can also set it up over the phone by calling 1-800-959-8281, or if for some reason you prefer, by mail.

Revenue Canada has a service called ‘My Account for individuals‘ which is a portal for Canadian taxpayers to view their tax and benefits information online, and I highly recommend signing up as ‘My Account‘ makes your life so much easier when tax time comes around or if you ever need anything from the CRA. With My Account you can view your T4s (and other slips), change your address, submit forms and requests and so on. Part of the options available to you online is a link to any uncashed cheques you may have!

You’ll also need to sign up for My Account if you intend to file taxes online.

How To Find Uncashed Cheques

Step 1

Log in to Revenue Canada’s My Account For Individuals. If you don’t have an account, you’ll need to make one.

You can also phone Revenue Canada at 1-800-959-8281 and speak to a taxpayer services agent to check if you have any uncashed cheques.

Step 2

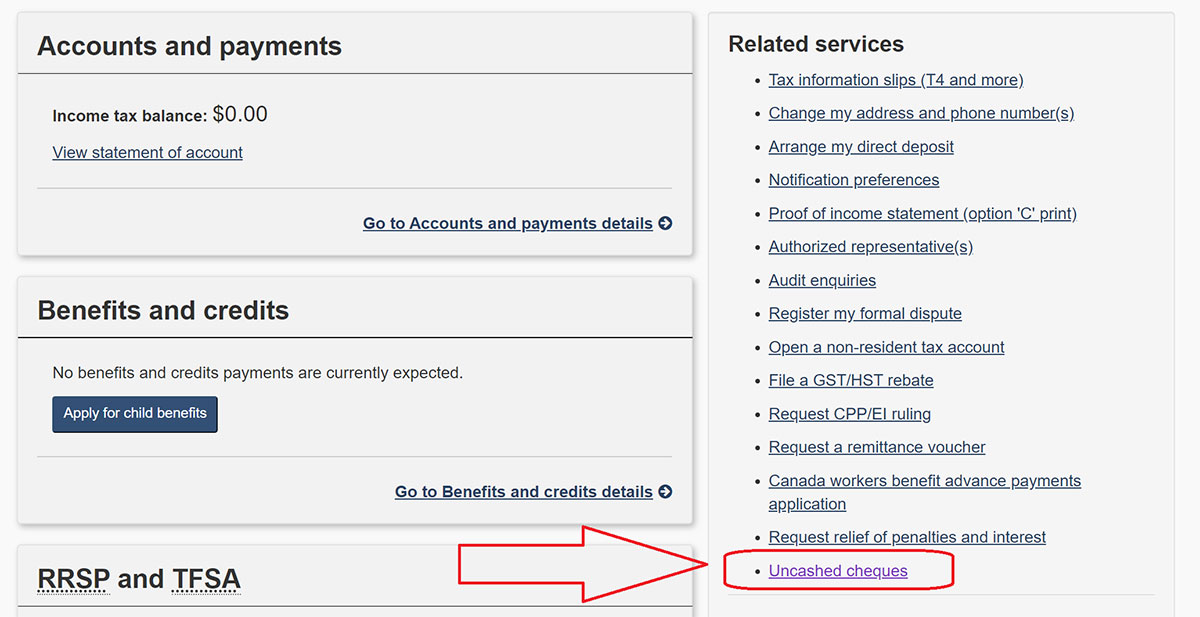

At the bottom of ‘Related services’ you’ll find an Uncashed cheques link, hold your breath, click it.

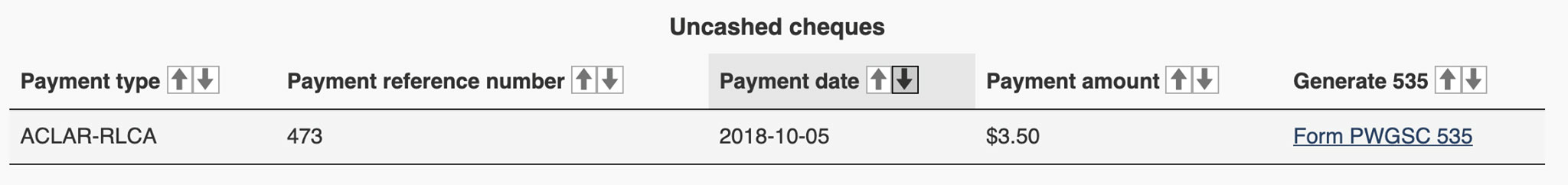

If you have an uncashed cheque, it’ll be listed here. For example:

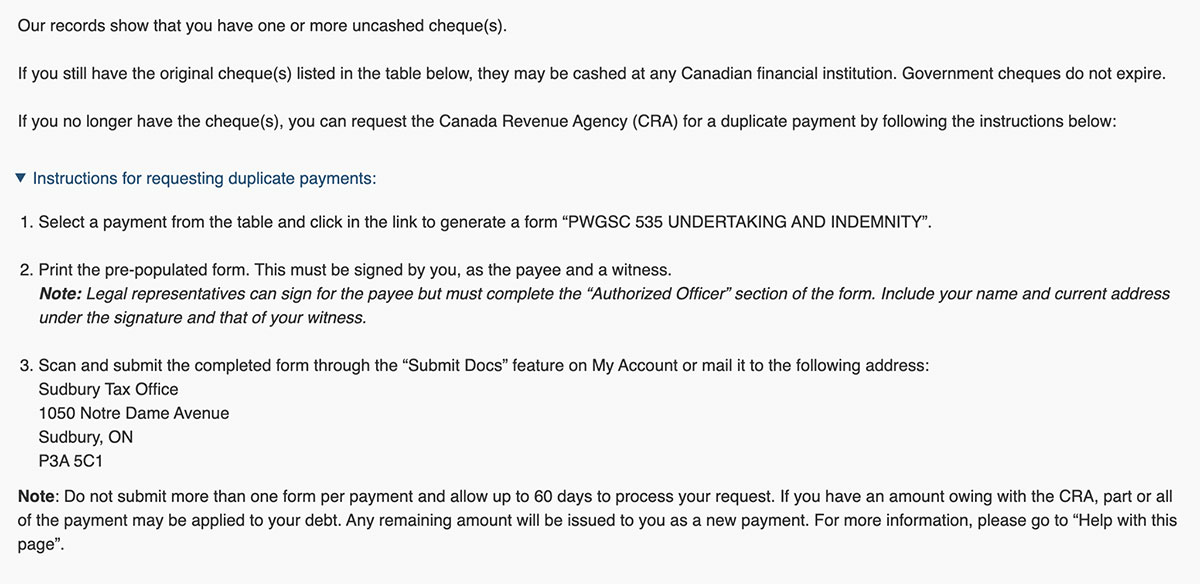

If you do have an uncashed cheque, congratulations on your find! You’ll need to fill out form PWGSC 535, print it off and mail it to Revenue Canada’s Sudbury Tax Office at the address mentioned, then you’ll get your payment someday. If you owe the CRA money, they’ll take their cut first before sending you what’s left, if anything.

Shared To Our Facebook Page

We made two posts on our Facebook page about finding uncashed cheques, and lots of people did! Check out these dollar amounts from each of the posts. I went through and added up the cheque amounts everyone found, and mentioned.

= $10,227.14 😊

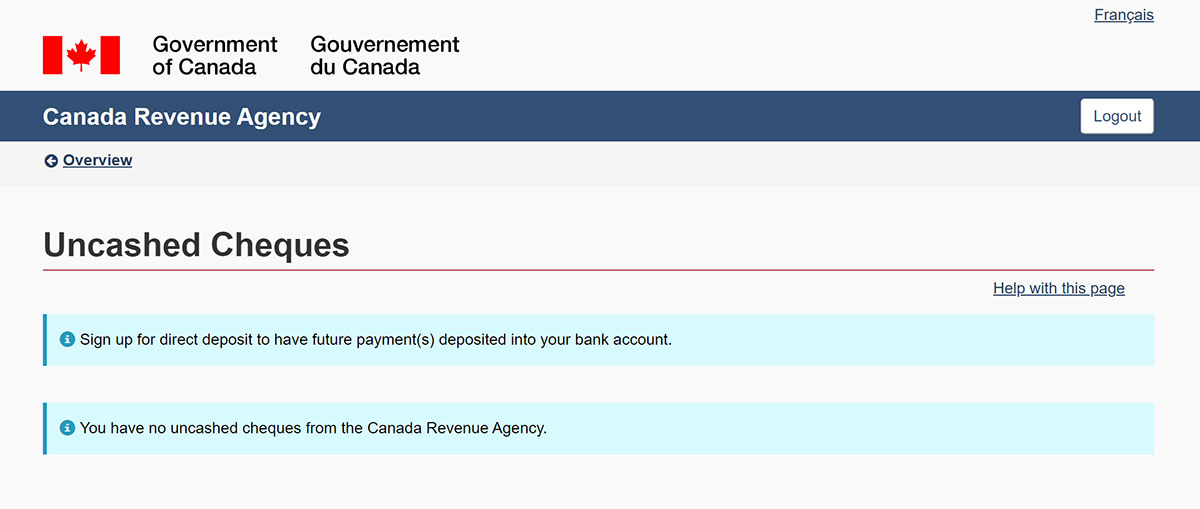

If you do not have any uncashed cheques, it’ll say as such. Good for you though! You didn’t generate any free interest money for the Government 😉

Register For My Account

Once you have your access code, login and take a look for any uncashed cheques!

If you need it, this video explains the entire process.

Conclusion

Hopefully you find a nice chunk of change! I wonder why Revenue Canada doesn’t send out notices for uncashed cheques?

- Also check this: The Bank of Canada has an online tool to check for any unclaimed balances they hold for people/businesses.

- You might like our other blog post: How to file your taxes online for free in Canada.

PS: you may need this 😝

Blogging in Calgary.

Follow along on Facebook, Instagram, Twitter. Join the Calgary Discord Server!

It is not right that they do not pay interest, but who can force them too. I wish I could they help my cheques for 16 years, every year I filed my taxes. They could of gave it to me anytime but chose not to. They should be forced to pay the interest

why are people happy about this? You just gave revenue Canada an interest-free loan for years when they had your name and address the entire time